Did you know that the lender is not the only one who looks at your credit score when buying a home? Unless you have recently purchased a home or refinanced the home you are currently living in, you may not be aware that insurance companies are now looking at credit scores. Insurance companies have learned that a person’s credit history is an accurate predictor of risk. According to Insurance Information Institute actuarial studies have shown that people with a low credit score are more likely to file a claim. Since insurance companies base their premiums according to the risk they are assuming, the lower the credit score, the higher the risk.

So, for those of you with excellent credit, congratulations! You reap the rewards of a lower premium.

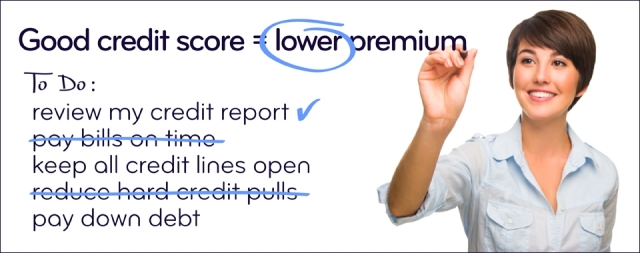

For those of you whose credit scores are sub-standard, there are a few steps that you can take to assist in a lower homeowner's insurance premium.

- Repair your credit. Before you go cutting up those credit cards, you may want to Google some tips on 'how' to repair your credit.

- Shop lenders. Lenders do vary in interest rates, points and fees.

- Consider raising your deductible. Of course, a higher deductible has to make sense in your financial situation.

For more information, contact me for my FREE Home buying eBook for SMART BUYERS.

Find your next home here!

- Aptos, California Real Estate

- Capitola, California Real Estate

- Freedom, California Real Estate

- La Selva Beach, California Real Estate

- Marina, California Real Estate

- Monterey, California Real Estate

- Moss Landing, California Real Estate

- Pacific Grove, California Real Estate

- Pajaro, California Real Estate

- Rio del Mar, California Real Estate

- Sand City, California Real Estate

- Santa Cruz, California Real Estate

- Seaside, California Real Estate

- Soquel, California Real Estate

- Watsonville, California Real Estate

Search Homes for Sale Santa Cruz, Aptos, Capitola, Rio del Mar, Watsonville, La Selva Beach, Pajaro Dunes, North Monterey County and surrounding areas

BUYERS: BUYER REPRESENTATION SERVICES (No Cost to Buyer) 831-531-8183

SELLERS: Want to know your HOME'S VALUE?

Follow me on:

Follow me on:

Follow me on:

Follow me on:

No comments:

Post a Comment